The News: Microsoft stock was mostly flat on Wednesday after the company reported better-than-expected fiscal first quarter results and slightly lower-than-expected quarterly revenue guidance.

Here’s how the company did:

- Earnings: $1.38 per share, excluding certain items, vs. $1.25 per share as expected by analysts, according to Refinitiv.

- Revenue: $33.06 billion, vs. $32.23 billion as expected by analysts, according to Refinitiv.

Analyst Take: The sentiment ahead of this week’s earning announcement was overwhelmingly positive, and the actual numbers reported didn’t disappoint. Microsoft has been consistently sitting as the market’s most valuable company by market cap, only to see Apple once again surpass it, but I speculate that this shift will be short lived. The key difference being Microsoft continues to deliver whereas Apple seems to be propelled by fumes of its glory years of a decades past. I digress…

Let’s dig into Microsoft earnings for this quarter.

Growth Across the Company, Mostly.

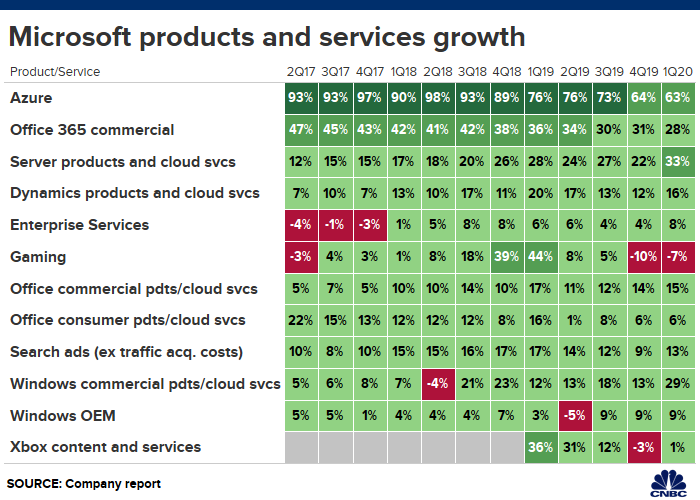

As background, here is a look across the Microsoft segments over the past 12 quarters. It’s easy to see the company has a lot of green with the biggest growth coming from Azure and Office 365, but across the organization growth has been mostly stable with gaming being the only laggard over the past few quarters. Windows Server and Dynamics have been bright spots for the company as well as various attached services.

59 Percent Cloud Growth is Good, Very Good

Yes, one quarter ago Azure growth was 64 percent, and yes, 59 percent is less, but the growth trajectory continues for Azure and just like Microsoft’s fiercest competitor in Cloud, AWS, as the overall number grows, the growth rate will likely become a bit lower.

In short, 59 percent is very good and Azure continues to gain momentum. Anyone who is indicating something different probably doesn’t know that they are talking about.

Looking Ahead: Guidance Solid, but lower than Revfinitive

Microsoft provided guidance for the next quarter at 35.15-35.95 Billion whereas Revfinitive was looking for a number just over 36 Billion. However, with expected cost of goods being significantly lower, Microsoft is showing improvements in margins, which should offer promise to another solid earnings next quarter if the company meets its own guidance.

Overall, Microsoft continues to perform admirably with growth, revenue and earnings all exceeding expectations. I have little reason to think that these trends aren’t sustainable for the near-term as the segments where Microsoft is investing including Cloud, Productivity and Gaming are all growing substantially, with a long ramp of growth as enterprise cloud is still at less than 25 percent.

Beyond Cloud, which gets a lot of the attention, Microsoft is also seeing consistent strength in Office 365 as well as Dynamics 365 with the latter being an interesting growth platform to watch with Microsoft much more formidable to take on the likes of Salesforce, Oracle, SAP and other legacy CRM/ERP leaders.

Microsoft earnings appeared to be just another day at the office for Nadella. All winning, with more of the same awaiting on the horizon.

Futurum Research provides industry research and analysis. These columns are for educational purposes only and should not be considered in any way investment advice.

Read more analysis from Futurum Research:

The IBM Hyper Protect Accelerator: Fueling Global Innovation

NVIDIA and Ericsson Team Up on AI Powered 5G VRAN

SAP Q3 Earnings Show Positives Amidst CEO Change

Image: Microsoft

The original version of this article was first published on Futurum Research.

Daniel Newman is the Principal Analyst of Futurum Research and the CEO of Broadsuite Media Group. Living his life at the intersection of people and technology, Daniel works with the world’s largest technology brands exploring Digital Transformation and how it is influencing the enterprise. From Big Data to IoT to Cloud Computing, Newman makes the connections between business, people and tech that are required for companies to benefit most from their technology projects, which leads to his ideas regularly being cited in CIO.Com, CIO Review and hundreds of other sites across the world. A 5x Best Selling Author including his most recent “Building Dragons: Digital Transformation in the Experience Economy,” Daniel is also a Forbes, Entrepreneur and Huffington Post Contributor. MBA and Graduate Adjunct Professor, Daniel Newman is a Chicago Native and his speaking takes him around the world each year as he shares his vision of the role technology will play in our future.