There is understandable animosity between the traditional oil and gas industry and renewables. Fossil fuel companies have reflexively held renewable energy resources in disdain, and vice versa. A different approach is needed. Childish fights over which resource is better need to give way as companies focus on finding good energy solutions for now and into the future.

A posture of infighting in the energy sector is not helpful. With consumer concern and engagement over the climate crisis and the ascendancy of renewables gaining more traction, a better way forward for energy companies is to work with what you’ve got, but also lean into the future with a focus on new technology.

Energy Companies Are Starting to Get Beyond Fear and Loathing

To explore that future, a glimpse into the recent past is helpful. I live in Oklahoma, where I’ve been watching what can best be described as an MMA-style blood sport for the past five years. Everybody has been out to win, largely by knocking the other guy out: Wind vs. Oil, Big Oil vs. Small Oil, Renewables vs. Fossil Fuels, Flare vs. Capture. While MMA might be your sport of choice, from a business standpoint, however, this kind of approach is incredibly ineffective. Moreover, it’s a great way to create a lot of lose-lose situations.

But there are signs this kind of animosity is waning. As growth in renewables continues, companies that have traditionally been tethered to oil and gas are showing clear signs of looking beyond fossil fuels.

Why is this a moment when I think getting beyond differences should be the order of the day? Why should oil and gas not just push forward the way they’ve always done? Because it’s short-sighted. Fortunately, there are plenty of signs that the industry understands this and is putting its R&D resources to good use for the future. Just look at Europe, where BP uses its Beyond Petroleum platform despite most of their assets still in oil and gas.

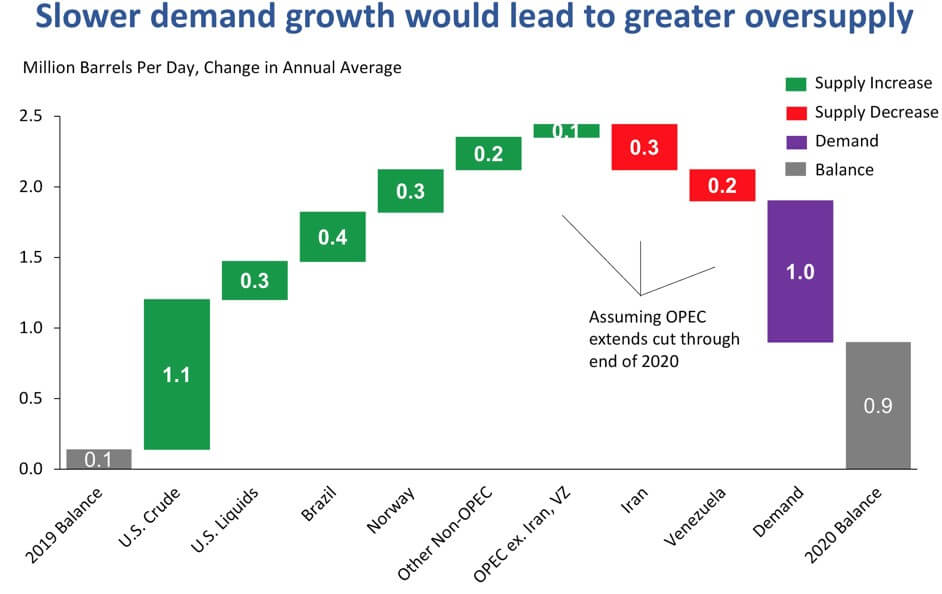

This change in attitude comes at an interesting time. In terms of access to the resource itself, the oil and gas industry has had the benefit of wind at its back in recent years. Yet this coupled with the growing interest in and the existential imperative of renewable energy is leading to slower demand for fossil fuels. On a pragmatic level, this kind of slowdown in demand could lead to a softening in profits in the short-term.

The idea of this supply/demand trend is not new, which is why on a global front, oil and gas companies have taken steps to invest in renewables. My colleague Jeff Risley wrote about that recently here if you’d like a deeper dive: Europe Leads the Charge in Clean Energy Investing — What’s Ahead for the US?

The good news is that the market speaks. A recent study from Deloitte shows a trend toward voluntary demand in renewables that is independent of demand driven by policy mandates. Investors are interested in putting money into plays in the renewables market, and traditional energy companies are responding. I think it is precisely in responding to supply and demand that a way forward beyond the battle between renewable and non-renewable resources can be seen.

Investment in Technology is a Good Play

While there is still plenty of money to be made in oil and gas, this is the time to make strategic investments in technology. For instance, Techstars has an Energy Accelerator program in partnership with Equinor. Through the accelerator, start-up companies participate in a 13-week mentoring program with the goal of “emerging from the program stronger, bolder, and better prepared to drive innovation in the global economy.”

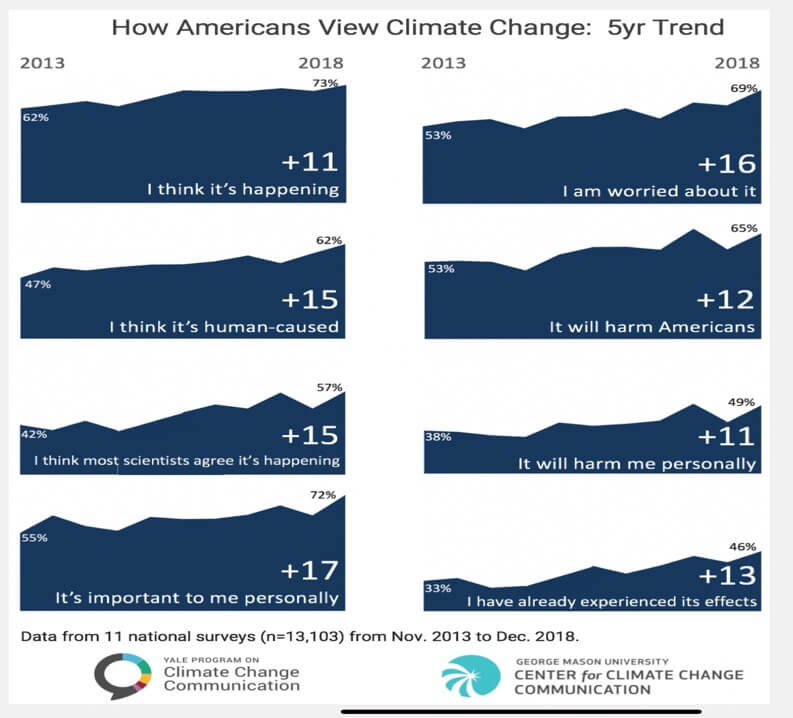

Energy firms would be smart to double down on such technology innovation and spend less time tearing down competitors, which ultimately weakens the position of everyone. Climate change has been decided: Americans understand it is an issue that needs attention. The graph below compiled in a joint effort by Yale Program on Climate Change Communication and George Mason University Center for Climate Change Communication shows changes in attitudes and understanding about climate change over the five years between 2013 and 2018.

While this trend suggests big changes need to be made in energy resources, currently renewables only make up 8 percent of power generation and the 50-year outlook is still driven by fossil fuels.

What Does This Mean for Energy Communicators?

Investor relations teams at public energy companies need to start making disclosures about their efforts to develop energy tech and balance that need with “single play efficiency” that is currently required. Though investors are wary of any deviance, no one can deny the change happening and the need for energy firms to have a future play beyond their current limited focus and activity.

I am not naive. Wind farm developers and oil executives are not all suddenly going to come together in a harmonious energy industry choir. But here’s the challenge I’ll leave you with: Let’s have tolerance for other forms of energy, and curiosity about how you might work together, and find the patience to work toward energy solutions that will serve the long-term needs of the constituents we all serve. In short, let’s hate the problem, not the resource. It starts with good communication. And it costs time and money to make that happen.

The original version of this article was first published on Saxum.

I live to influence others who seek to make the world a better place. As CEO of Saxum, an integrated marketing communication consulting agency I founded in 2003, I hope to be described by my peers and critics alike as bold. I’ve built my reputation by adding value to the lives of CEOs, entrepreneurs and the kid right out of college who is looking for some advice. I’m passionate about the lives of the team I work with at Saxum, a cadre of competitive professionals who can be described as brave, original, lively and driven.